- Compare Blended Rates v Interchange Rates.

- Bespoke pricing that suits your business requirements.

- We identify the hidden fees to maximise your savings.

- We make switching payment providers seamless and easy.

- Avoid cardholder not present uplift charges.

- We have solutions for businesses in high risk sectors.

Which Card Processing Solution does your business need?

Compare many of the latest digital payment solutions, including card merchant services & credit card processing solutions tailored to your business needs. Whether you’re a small business or a large enterprise, we offer the best solutions to streamline your payment processes.

Compare many of the latest digital payment solutions, including:

Chip and Pin Terminals

For all types of card payments, we recommend either Ingenico terminals (the market leader in card reader technology), the Pax A920 (as left), or the more basic A900. As long as you have access to a router/Wifi or GPRS, they will facilitate card payments as swiftly as possible. These terminals are NFC-enabled to facilitate contactless payments, too.

From our experience and that of thousands of merchants, these terminals have been proven to be functional, durable, and reliable, and the cost ranges from £10 – £25 + VAT per month. Since January 2023, the recently introduced PSR regulation states that any terminal agreement must be no longer than 18 months.

To get a quote or book a 5-minute call to learn more about our debit/credit card payment merchant services, click on the buttons below:

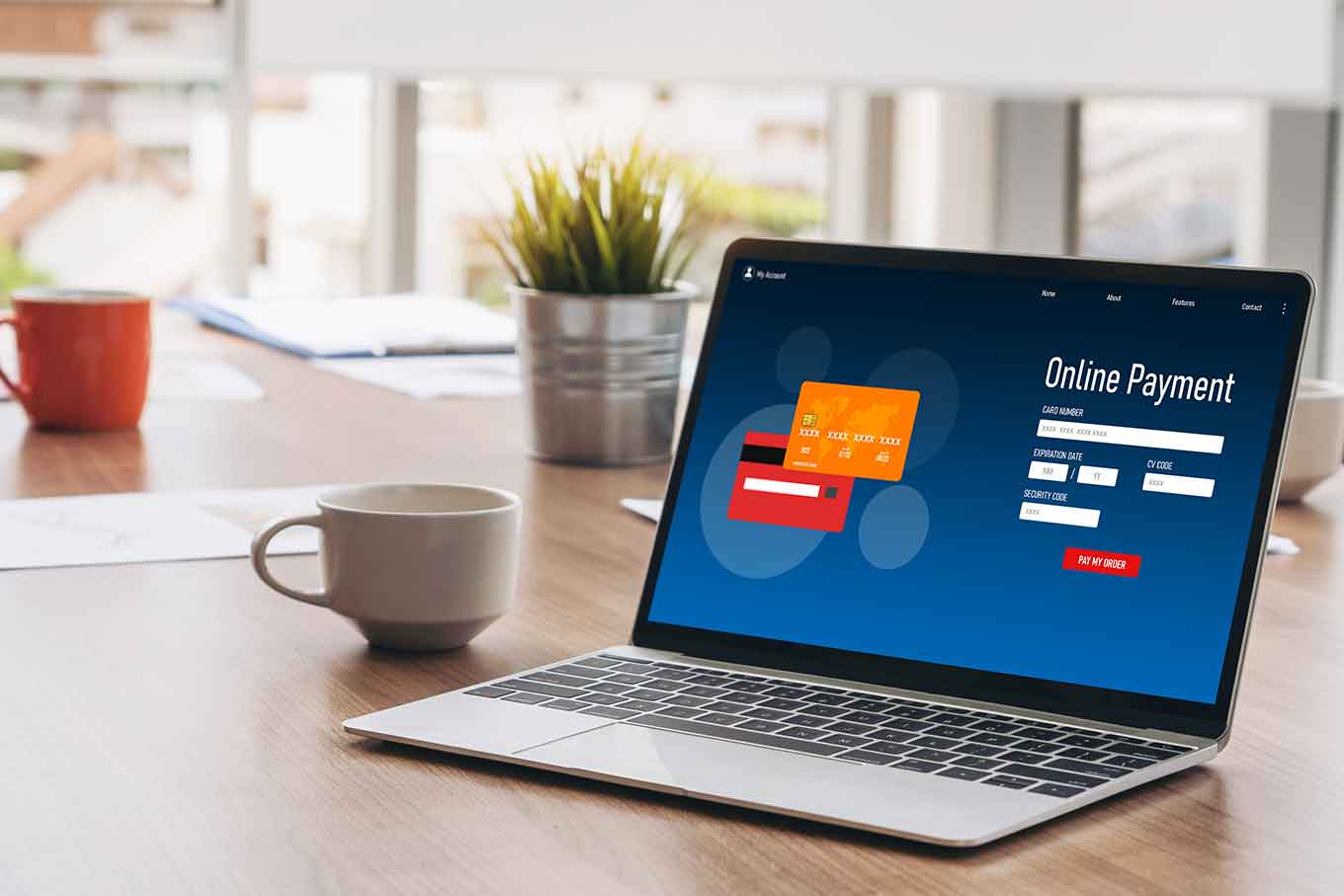

Online Payments

When looking for a payment provider, consider the following: Acceptability, Risk and Compliance, Security, Reporting, and analytics.

There are many factors to consider, including debit and credit card fees such as payment solutions for all payment devices, Gateway integration, accounts integration, authentication, and much more.

Online payments are an essential part of any online business, but it’s important to remember that there are a variety of different payment providers out there, each with their own unique features and capabilities.

Payment providers have different services and fees, which you will have to consider. To help you make the right choice, review the provider’s pricing, supported countries, card funding options, and customer service reputation.

We can help you navigate through the technical jargon to arrive at an online payment solution that’s right for your business.

All our approved online providers are FCA-regulated financial institutions.

Virtual Terminal

Ideally most or all of your card payments are taken when the customer is not present, usually over the phone or by email. A Virtual Terminal is the perfect solution, as you and other members of your team can have individual online logins to access a secure payment portal to take payments over the phone.

You can also take payments by sending a link that your customer clicks to open up the same portal to make a payment.

There is no need for a card reader, eliminating the need to rent a terminal. The costs for a Virtual Terminal can range from £0 per month to £20 per month. All you will pay is the agreed fee for processing the card type and a monthly fee of no more than £5 per month for PCI compliance.

Contact us to discuss which option is best for you.

High Risk Payments

A bank may consider your business riskier than standard merchant accounts due to mitigating factors such as the number of chargebacks, credit rating, industry type and others (listed below). If this is the case, then your business will require a high-risk merchant account.

A business with a high-risk merchant account will normally have to pay higher fees with extra checks and balances due to these aforementioned risk factors – We at Independent Merchant Services are here to help you decide the best path for your business and answer all the questions you may have on the process.

Bank underwriters will assess your business for the element of risk exposure from your business:

- A historic high number of chargebacks

- Bad reputation (adult industry, debt collectors etc.)

- An average ‘sales ticket’ is greater than £50

- Poor credit rating

- Financial instability

- The average monthly sales volume is over £15,000

Pay by Link

Pay by Link is a fast, secure and simple way to get paid. Send your customers an email or text message containing a link for quick and easy payment.

If you are looking for a secure way of receiving payment before dispatching the goods, why not email your potential client a “pay by click” link!

Simply email/text or send a QR link to the customer, and they will be taken to a payment portal where they can securely input their credit or debit card details. Once they click “Pay” your business will be notified of the payment transaction. Once authorised, you can be confident of a secure transaction and release the goods or services to the customer.

Payment Gateway

A payment gateway is a technology product built to ensure your online payments are captured in a safe and secure environment. It passes the relevant card details from your website to your merchant bank /acquirer.

There are providers that supply stand-alone gateways and leave you to choose your own acquirer to process the payments. However, we would recommend the many benefits of working with a single provider who can provide both the gateway and acquiring together and keep the whole operation under one roof.

In addition to handling standard card payments, you should consider offering your customers other ways to pay – for example, via their preferred wallet (Applepay/Googlepay), or via Bank Transfer.

A gateway that can offer all of these will help improve your customer’s payment experience, building trust, loyalty and repeat business.

Pay as You Go

The most competitive no-contract solution we recommend is with TIDE.

Whilst the card fee rate you will be charged for both credit and debit cards will be 1.5% per transaction, there are absolutely no other fees such as PCI fees/Transaction fees/Minimum billing.

The readers cost a one off £89 per card reader and can be used whenever you need them – just link the reader via Bluetooth to your smartphone and it will take payments immediately. Why don’t you try one , test it and then order more as required. There is a 30-day refund anyway.

The monies are transferred to your bank account in two days.

Click the link below to benefit from the special offer pricing.

What is PCI DSS?

All businesses with merchant accounts are responsible for protecting cardholder information and must comply with regulations laid down by the PCI DSS.

PCI DSS (Payment Card Industry Data Security Standard) was introduced in 2006 to create a secure environment for all companies that accept and process card transactions and consumer data. It lays down a set of requirements to help ensure the safe handling of cardholder data and applies to businesses that take credit/debit cards regardless of the size and volume or the transactions. All merchants must register within a few months to avoid monthly penalties for PCI non-compliance.

Your merchant service provider will be able to ensure that you achieve compliance with the minimum of fuss. They will, however, charge a monthly fee for this. This fee varies by provider.

How we can Help Our approved providers have programs in place to guide you through the online process and ensure that you avoid the unnecessary and avoidable charges imposed by banks. For more information, visit the PCI compliance website or contact us.

We can advise you on how to become compliant and avoid paying unnecessary penalties for being non-compliant.

No junk mail. No spam calls. Free Quotes

Choose the best & most reliable card payment provider for your business with Independent Merchant Services